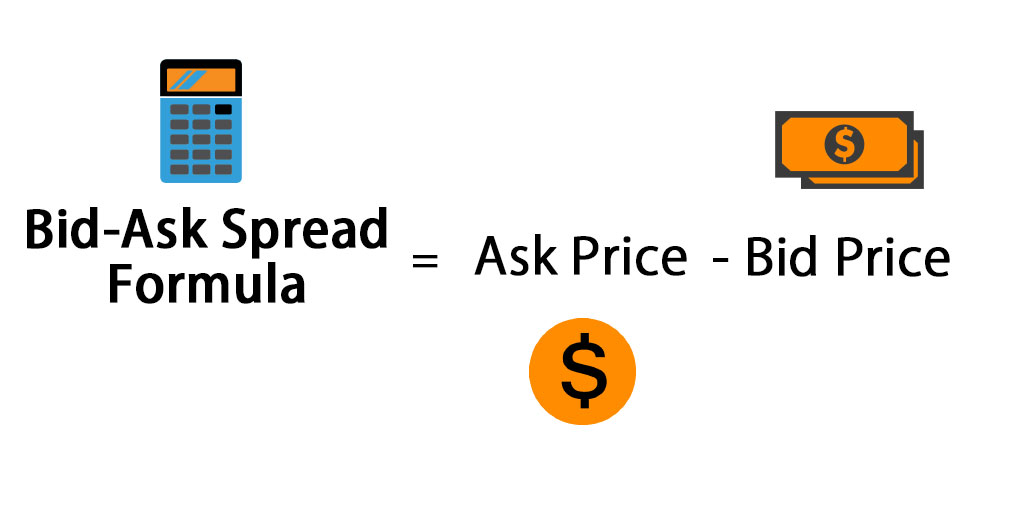

Bid ask spread formula

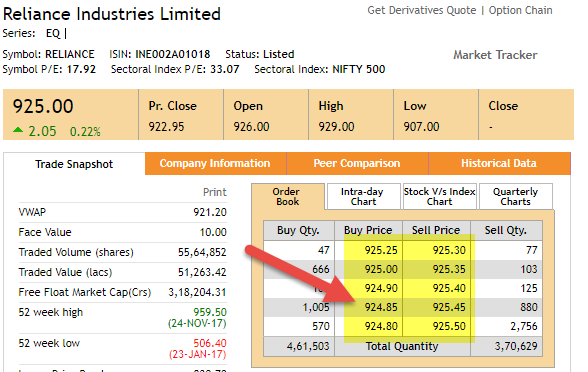

361 August 12 2021 Quoted Bid-Ask Spread Formula The quoted bid-ask spread is the difference between a market maker s a dealer s ask and bid price quotes at a given point. The ask price refers to the lowest price a seller will accept for a security.

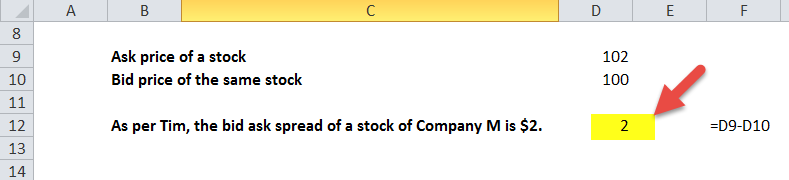

Bid Ask Spread Formula Step By Step Bid Ask Spread Calculation

The difference between these.

. A Superior Option for Options Trading. Bid-offer or bid-ask spread is calculated as. Ad See How to Make Money Online.

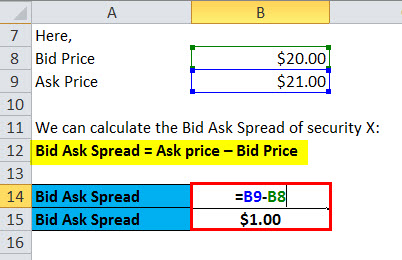

The bid price is always lower than the ask price which should be intuitive since no seller would decline an offer price of. To calculate the bid-ask spread percentage simply take the bid-ask spread and divide it by the sale price. Let us get to the forking of the formula.

Effective spread 2 trading price - midpoint of market quote at time of order Also it is sometimes expressed as Effective spread. The bid ask spread may be used for various investments and is primarily. The bid-ask spread in this case is 5 cents.

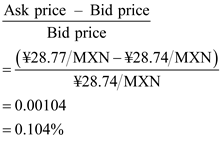

Bid ask spread 005. Spread 2 x Ask Bid AskBid x 100 How Market-Makers Set the Bid-Ask Price Foreign exchange transactions. A buyer who acquires the stock at 10 and immediately sells it at the bid price of 995either by accident or designwoul.

For instance a 100 stock with a spread of a penny will have a. Bid-Ask Spread Ask Price Bid Price. The bid price refers to the highest price a buyer will pay for a security.

For instance a 100 stock with a spread of a penny will have a. In equation form this spread is given by. Get your Free Copy here.

Formula -------------------------------------------- Bid-Ask Spread Formula Ask Price Bid Price Interpretation -------------------------------------------- - If the Bid-Ask spread is low. Effective spread 2 trading price midpoint of market quote at time of order Also it is sometimes expressed as Effective spread. The bid ask spread formula is the difference between the asking price and bid price of a particular investment.

The spread as a percentage is 005 10 or 050. Get your Free Copy here. So here we have a stock which is.

Spread Ask - Bid The spread is the difference between the quoted sale price bid and the quoted purchase price ask of a security stock or. Let us work the rather easy formula. Tighter spreads are a.

Consider a stock trading at 995 10. Discover how my Weekly Paycheck Method tripled account in 8 mo. For the stock in the example above the bid-ask spread in percentage terms would be calculated as 1 divided by 20 the bid-ask spread divided by the lowest ask price to yield.

For example assume Morgan Stanley Capital International MSCI wants to. The spread is the difference between the bid price and ask price prices for a particular security. Formula Bid-Ask Spread Ask Price Bid Price Market Bid-Ask Spread Best Ask Price Best Bid Price Askoffer price or ask is the price at which the dealer sells and bid price.

To calculate the bid-ask spread percentage simply take the bid-ask spread and divide it by the sale price. Discover how my Weekly Paycheck Method tripled account in 8 mo. Bid ask spread Ask price bid price.

This spread is taken directly from quotes that is posted prices. The bid price is 995 and the offer price is 10. Ad See How to Make Money Online.

The bid-ask spread for a stock is the difference in the price that someone is willing to pay the bid and where someone is willing to sell the offer or ask. Using quotes this spread is the difference between the lowest. The simplest type of bid-ask spread is the quoted spread.

Free Education No Hidden Fees and 247 Support. In equation form this spread is given by. To do that we simply use the spread formula.

Absorption Costing Formula Calculation Of Absorption Costing

/GettyImages-525348438-0cdffe67f1574eb39c2c3b3a949b058e.jpg)

How To Calculate The Bid Ask Spread

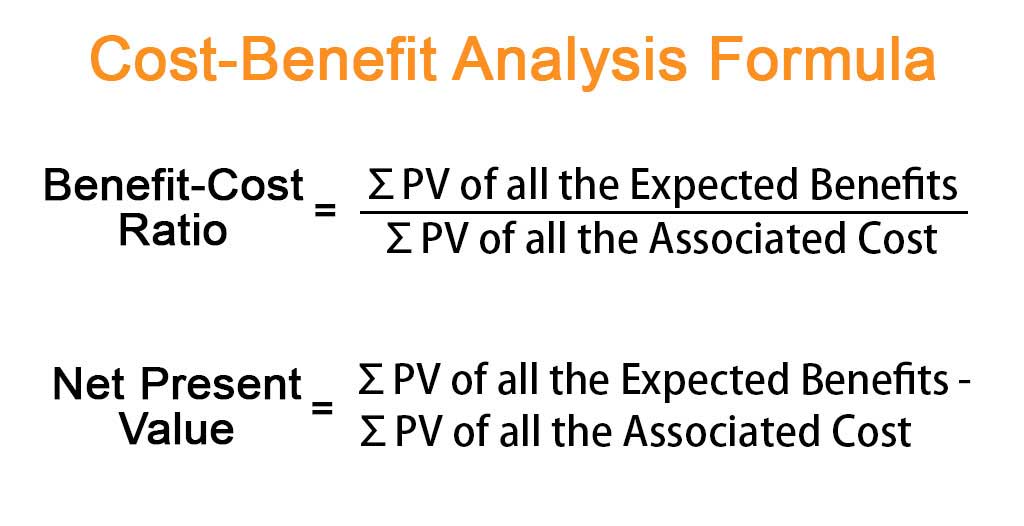

Cost Benefit Analysis Formula Calculator Example With Excel Template

Theoretical Models For Options Bid Ask Spread Quantitative Finance Stack Exchange

Bid Ask Spread Formula Step By Step Bid Ask Spread Calculation

Bid Ask Spread Formula Calculator Excel Template

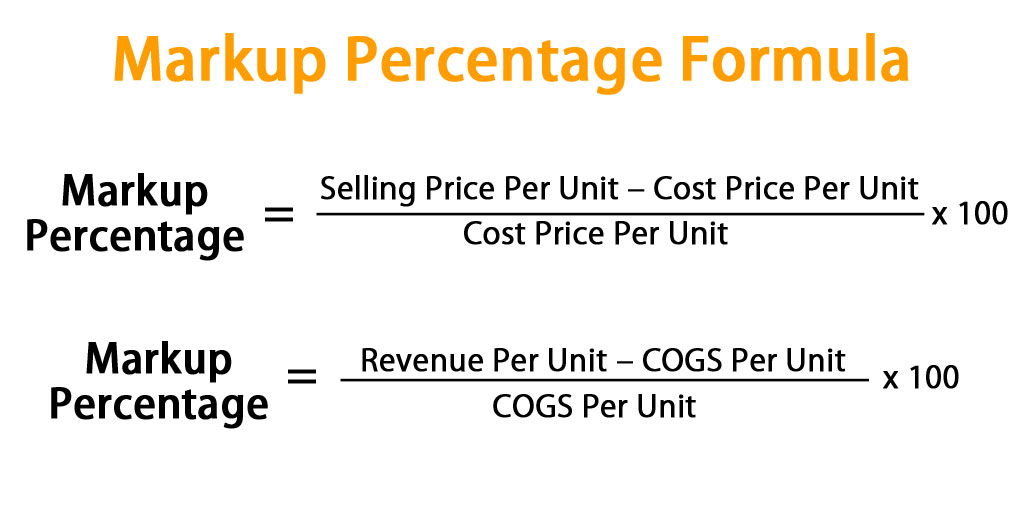

Markup Percentage Formula Calculator Excel Template

Bid Ask Spread Formula And Percentage Calculation Example

What Does A Forex Spread Tell Traders

Bid Ask Spread Telegraph

Dealers And Bid Ask Spreads Ppt Video Online Download

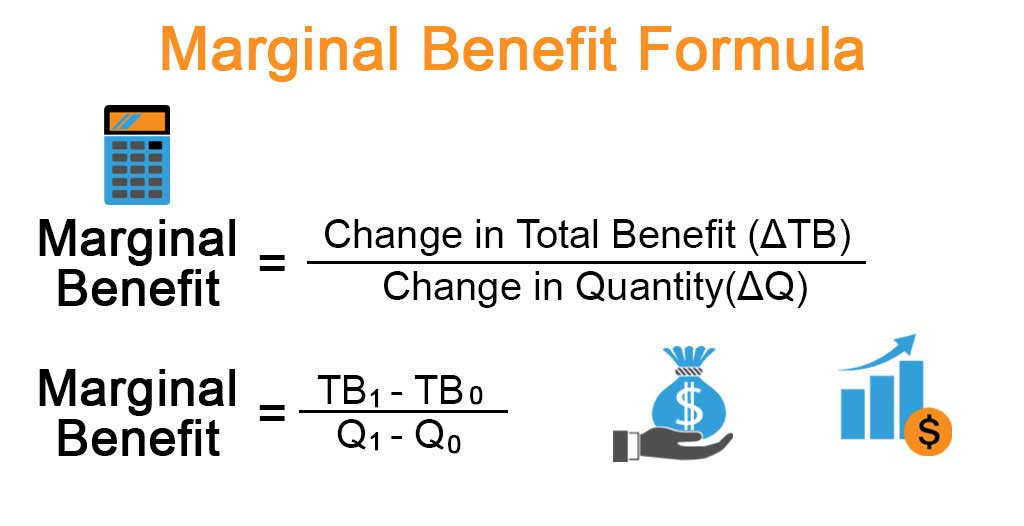

Marginal Benefit Formula Calculator Examples With Excel Template

How Can We Calculate The Foreign Exchange Spread Fasapay Information Center

Bid Ask Spread Formula Calculator Excel Template

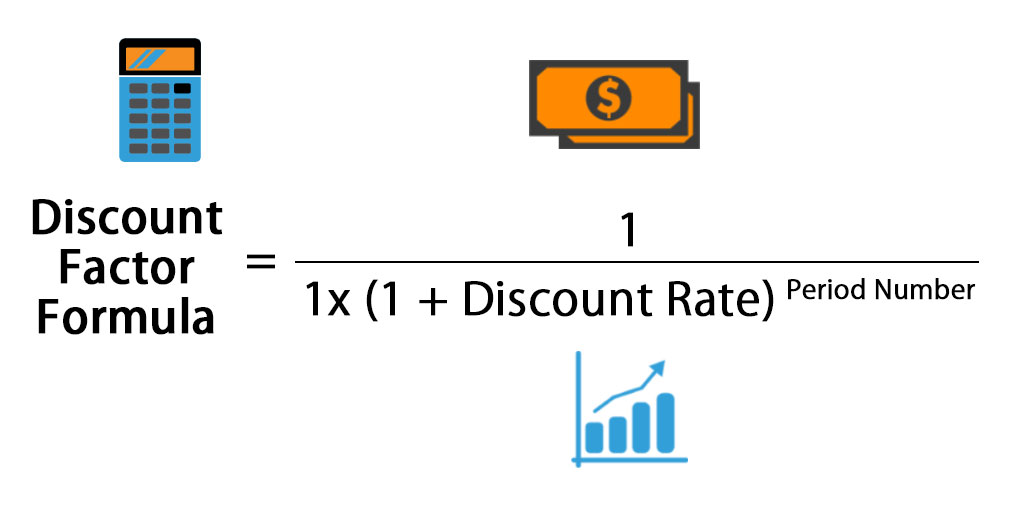

Discount Factor Formula Calculator Excel Template

Cost Of Goods Manufactured Formula Examples With Excel Template

Solved Chapter 4 Problem 5p Solution Multinational Finance 4th Edition Chegg Com